Facing the fiscal cliff

It’s hard to watch the news lately without hearing about the “fiscal cliff” awaiting Americans early next year — more than $500 billion in automatic spending cuts, tax increases and other fiscal changes set to kick in starting in January.

These questions, coupled with the paralyzing federal budget deficit and national debt, will have a significant impact on Delawareans.

These questions, coupled with the paralyzing federal budget deficit and national debt, will have a significant impact on Delawareans.

Although I’ve worked on deficit reduction consistently during my two years in the Senate, my staff and I have invested additional time and energy these last few months preparing for the immediate economic choices required by the events of the fiscal cliff. Just as we do with our legislative briefing emails, I wanted you to have access to some of the same background and analysis that I do.

We’ve put together a white paper on the fiscal cliff — a primer on the economic issues Congress and the President are now working to confront — to give you a better idea of what to expect.

Click here for your copy of the white paper and to share your opinion on the fiscal cliff.

As it stands now, our budget deficit and national debt are simply unsustainable. A $1.3 trillion deficit and $16.3 trillion debt are unacceptable. This level of debt hurts our nation’s competitiveness, causes interest rates to rise over the long term and crowds out critical investments in our country’s future.

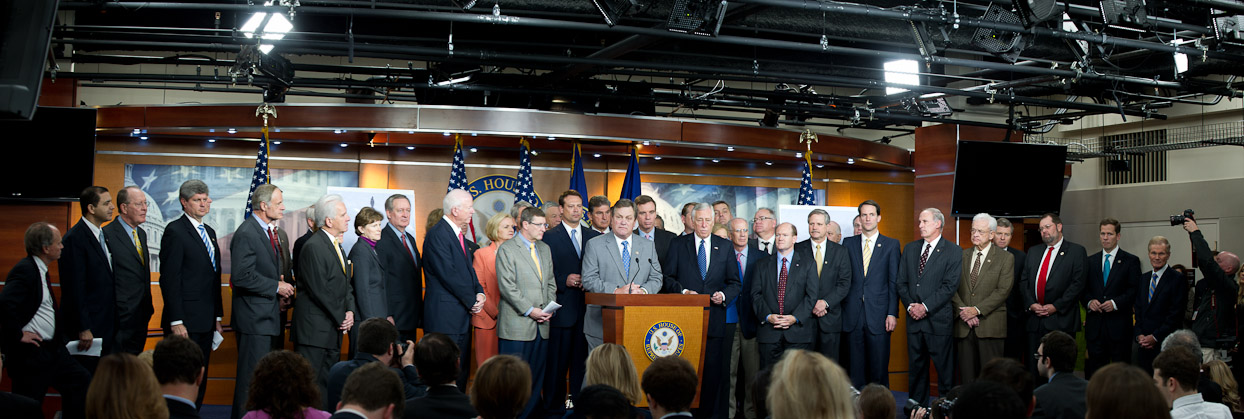

Congress should get a big, bipartisan deal done now to reduce our deficit and avert the very significant impact of the fiscal cliff, rather than waiting until next year.

It seems like an easy choice to simply kick the can down the road again, but the reality is that our country will need to make an array of tough decisions about our competing economic priorities over the next few months – priorities like keeping taxes low, investing in critical services, reducing our unsustainable annual deficits and stabilizing our debt.

I hope you’ll download my new white paper and share your opinion on the fiscal cliff.

There is no doubt that we can keep our nation moving forward, but we’ll have to work together to do it. Balance is the only responsible solution.

Best –

Chris Coons

U.S. Senator