Determining a Target Retirement Saving Rate

A secure retirement is one of your goals, right? The worksheet in this video can help you get there.

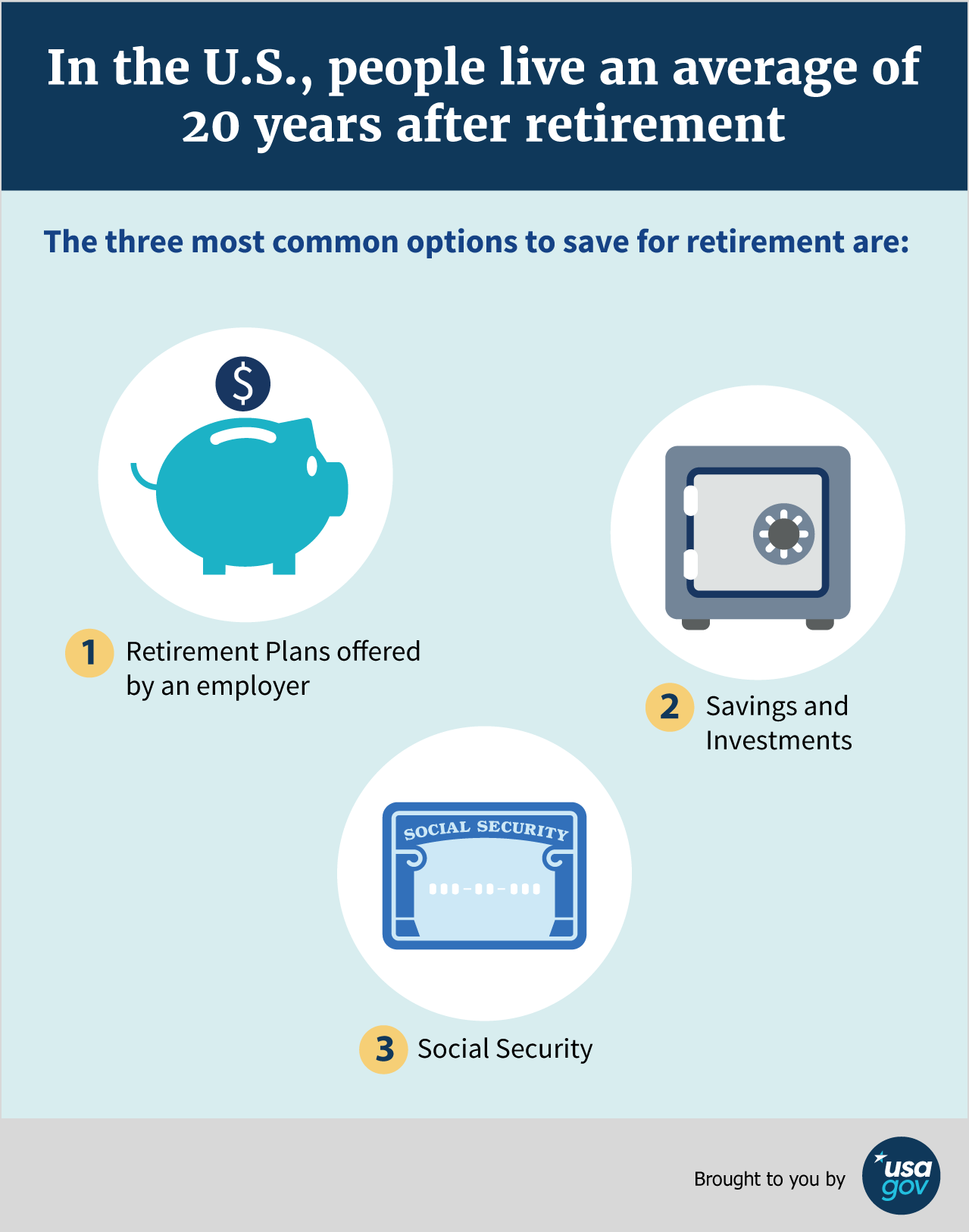

When setting up your budget, it is important to include retirement savings. You can save through a retirement plan at work, on your own, or both. The target retirement savings rate tool will help you determine how much you need to save each year. The sooner you start saving, the longer your savings have to grow.

The worksheet will help you estimate what percentage of your current annual salary you should be saving. While it does not take into account your unique circumstances, it will help you plan for your retirement goals.

The worksheet asks for four pieces of information:

- Number of years until retirement (your planned retirement age minus your current age)

- Current annual salary

- Number of years you expect to spend in retirement

- Current savings

The worksheet assumes that you’ll need to replace about 80 percent of your pre-retirement income. Social Security retirement benefits should replace about 40 percent of an average wage earner’s income after retiring. This leaves approximately 40 percent to be replaced by retirement savings. Keep in mind, this is an estimate and you may need more or less depending on your individual circumstances.

How many years do you have left until retirement?

The more years you have until retirement, the less you will have to save each month to reach your goal. No matter your age, for every 10 years you delay starting to save for retirement, you need to save 3 times as much each month to catch up.

How long will you live in retirement?

Based on current estimates, a 65 year old man can expect to live approximately 18 years in retirement, and a 65 year old woman can expect to live about 20 years, but many people live longer. Planning to live well into your 90s can help you avoid outliving your income.

The worksheet takes into account some factors that impact your retirement savings. First, investing - because it involves risk. Second, inflation - because today’s dollars will usually buy less each year as the cost of living rises. Your target savings rate includes any contributions your employer makes to a retirement savings plan for you, such as an employer matching contribution. If, for example, you are in a 401(k) plan in which you contribute 4 percent of your salary and your employer also contributes 4 percent, your saving rate would be 8 percent of your salary.

By using the worksheet, you’ve figured out your target savings rate. It gives you a rough idea –a savings goal. Some may face higher expenses in retirement because of personal circumstances. For example, if you or your spouse have a chronic medical condition, you may want to save more. Some may have other sources of income in retirement such as a traditional pension or money from selling a home that would lower their target savings rate.

If you are not currently saving this amount, don’t be discouraged. The important thing is to start saving – even a small amount – and increase that amount when you can. Come back and update this worksheet from time to time to reflect changes and track your progress.

Here are a few tips on how to save smart for retirement:

- Start now. Time is critical. Start small, if necessary.

- Use automatic deductions from your payroll or your checking account.

- Make saving for retirement a habit.

- Be realistic about investment returns.

- If you change jobs, keep your savings in the plan or roll them over to another retirement account.

- Don’t dip into retirement savings early.

- If you pay someone for investment advice, ask them to confirm in writing that they are “fiduciaries”—meaning they are obliged to work in your best interest.

To track other resources you may have in retirement, start by getting your Social Security statement and an estimate of your retirement benefits on the Social Security Administration’s website, www.socialsecurity.gov/mystatement.

The online interactive target retirement savings rate worksheet and other financial planning worksheets are available on EBSA’s website: www.dol.gov/agencies/ebsa. You can save your worksheet data there so that you can come back to update it to track progress or adjust for changes.

You can order a free copy of the Savings Fitness publication or contact a Benefits Advisor with questions electronically at askebsa.dol.gov or by calling toll-free 1-866-444-3272.

Get started today for a secure financial future!