Payroll, Taxes

Payroll processing

The LANL Oracle Payroll Team is responsible for processing payment of salary and wages to all LANS non-craft employees based upon each employee's HR record. Included as part of the net pay calculation are deductions for taxes, insurances, retirement plans, involuntary deductions (wage orders), and voluntary deductions such as United Way. Sources for determining deductions include tax forms submitted by the employee (or defaults where no form is submitted), the employee's benefit record, enrollments with retirement plans, wage orders, and voluntary elections made by the employee.

Payroll direct deposit

The Payroll Team can address questions regarding direct deposit, Form W-4 Employee's Withholding Allowance Certificate (pdf), and wage orders; however, questions regarding other deductions may need to be directed to the Tax or Benefits Accounting Team, depending on the source of the deduction. Paydays are biweekly on Thursdays. The Lab Payday/Holiday Calendar (pdf) reflects paydays as a colored box on Thursdays.

Direct deposit is a condition of hire for new hires. After submitting the LANL Payroll Check Direct Deposit Authorization Form (pdf), Lab employees are paid via direct deposit to the specified account. Changes from one account to another require a pre-notification ($0 sent to the new bank) and will result in a hard-copy check for one pay period. The check will be sent to your mail stop.

Craft payroll processing and direct deposit

The Craft Payroll Team is responsible for the payment of salary and wages to all union employees. We also compute and withhold the proper taxes such as federal income tax, state income tax, Social Security, and Medicare. We deduct the employees' agreed-upon, union-related deductions and/or applicable garnishments. We also file all the required state and federal tax reports and submit payments to those agencies. At calendar year end, we are responsible for processing and filing W-2 forms to the appropriate governmental agencies.

Craft Payroll is a weekly payroll; wages are paid on Thursdays. See also craft payroll forms (right) including the direct deposit form.

Foreign national new hires tax status

Except for Legal Permanent Residents or green card holders, foreign national new hires need to meet with a Tax Department representative when they begin work. A representative will be available to meet with you on Tuesdays at 9:30 am (or the day after you hire on) to determine your tax status and collect tax forms.

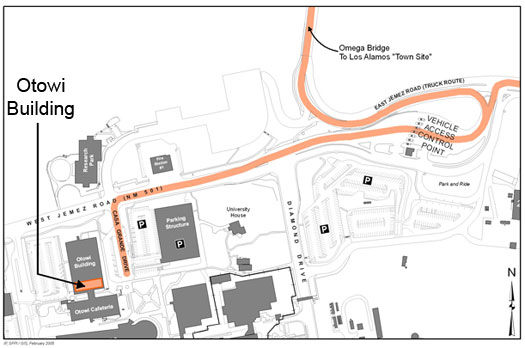

To locate the Tax Department, go to the north side of the basement of the Otowi Building (building 261) and look for signs that read, "Foreign Nationals Check in Here." Please bring your passport, visa, and DS2019 or I20 to this meeting. For more information, refer to Foreign National Tax Frequently Asked Questions (pdf).