Understanding your CP24E Notice

We made changes to your return because we found a difference between the amount of estimated tax payments on your tax return and the amount we posted to your account. You have a potential overpayment credit because of these changes.

Printable samples of this notice (PDF)

Tax publications you may find useful

- Publication 1, Your Rights as a Taxpayer

- Publication 3498-A, The Examination Process (Examinations by Mail)

- Publication 3598, What You Should Know About the Audit Reconsideration Process

- Form 1040-ES, Estimated Tax for Individuals

- Publication 505, Tax Withholding and Estimated Tax

- Find a copy of any necessary tax forms and instructions

How to get help

Calling the 1-800 number listed on the top right corner of your notice is the fastest way to get your questions answered.

You can also authorize someone (such as an accountant) to contact the IRS on your behalf using this Power of Attorney and Declaration of Representative (Form 2848).

Or you may qualify for help from a Low Income Taxpayer Clinic.

What you need to do

- Read your notice carefully — it will explain the changes we made to your return.

- Check the list of payments we applied to your account to see if we applied all the payments you made.

- Correct the copy of your tax return that you kept for your records.

- You don't need to do anything if you agree with the notice.

- If you disagree with the notice, please contact us at the toll-free number listed on its top right-hand corner (within 60 days of the notice’s date).

You may want to...

- Download copies of the following materials (if they weren't included with your notice):

- Call 1-800-TAX-FORM (1-800-829-3676) to have forms and publications mailed to you.

- Complete and send us a Form 2848, Power of Attorney and Declaration of Representative to authorize someone (such as an accountant) to contact us on your behalf.

- Call the toll-free number listed on your notice within 30 days if you want to instruct us to apply your credit to your next year's taxes.

- Review this year's estimated tax payments to avoid an underpayment when you file your taxes next year.

Answers to Common Questions

Is an overpayment credit different from a refund?

You get an overpayment credit when your tax payments exceed what you owe. You will receive the overpayment credit as a refund automatically. You also, however, can ask us to apply the credit as an advance payment towards your next year's taxes instead of sending it to you as a refund.

When can I expect to receive my refund?

You will receive it in four to six weeks if you owe no other taxes or debts we're required to collect.

What can I do if I don't receive my refund in four to six weeks?

Call us at the toll-free number listed on the top right-hand corner of your notice.

How can I find out what caused my tax return to change?

Please contact us at the number listed on your notice for specific information concerning your tax return.

What should I do if I find you misapplied a payment or haven't credited a payment that I made?

Contact us with your information at the toll-free number listed on your notice. Please have your documentation (such as cancelled checks, amended return, etc.) ready when you call. Our representative will discuss the issue with you and give you further instructions.

What should I do if I disagree with the changes you made?

Contact us at the toll free number listed on the top right-hand corner of your notice.

How do I adjust my estimated tax payments?

You can adjust your estimated tax payments by completing a Form 1040-ES, Estimated Tax for Individuals. See Publication 505, Tax Withholding and Estimated Tax for more information.

What should I do if I need to make another correction to my tax return?

You'll need to file Form 1040X, Amended U.S. Individual Income Tax Return.

Tips for next year

Consider filing your taxes electronically. Filing online can help you avoid mistakes and find credits and deductions that you may qualify for. In many cases you can file for free. Learn more about e-file.

You can receive your refund quickly with a direct deposit to your bank account by completing the banking information in the refund section of your tax return.

Understanding your notice

Reading your notice

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

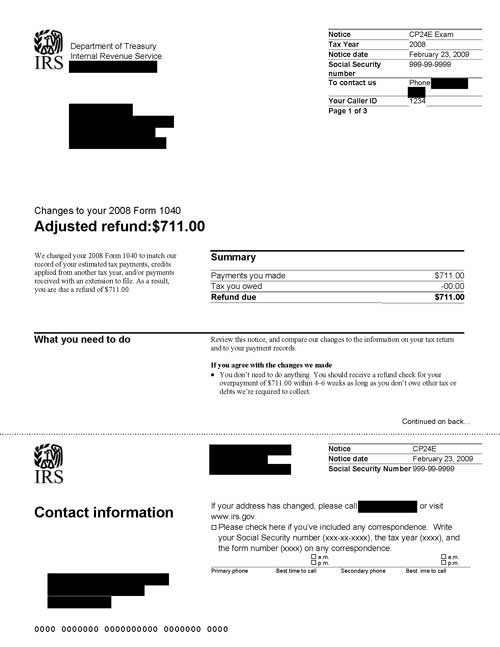

Notice CP24E, Page 1

Notice CP24E, Page 2

Notice CP24E, Page 3