Understanding your CP259H Notice

We sent you this notice because our records indicate you are a tax-exempt political organization and you did not file a required Form 990/990-EZ, Return of Organization Exempt From Income Tax.

Printable samples of this notice (PDF)

Tax publications you may find useful

- Publication 557, Tax Exempt Status for Your Organization

- Publication 583, Starting a Business and Keeping Records

- Publications 4221-PC, 4221-PF, and 4221-NC - Compliance Guides for tax-exempt organizations

- Form 990 Filing Threshold

- Find a copy of any necessary tax forms and instructions

How to get help

Calling the 1-800 number listed on the top right corner of your notice is the fastest way to get your questions answered.

You can also authorize someone (such as an accountant) to contact the IRS on your behalf using this Power of Attorney and Declaration of Representative (Form 2848).

What you need to do

- Disregard this notice if you have filed the return within the last four weeks using the same name and EIN listed on the notice.

- Otherwise, file your required Form 990 or Form 990-EZ immediately according to the instructions on the notice.

- If you don't think you need to file, complete the Response form enclosed with your notice and mail it to us using the envelope provided.

- If you filed more than four weeks ago or used a different name or EIN, complete the Response form enclosed with your notice and mail it to us in the envelope provided along with a signed and dated copy of the return.

You may want to...

- Review the filing requirements for your organization at Tax Information for Charities & Other Non-Profits.

- Review the information found at Political Organizations - Annual Income Tax Returns.

Answers to Common Questions

Which political organizations must file a Form 990 or Form 990-EZ?

A tax-exempt political organization must file Form 990 or 990-EZ if it has gross receipts of $25,000 or more, unless excepted. A political organization that is a qualified state or local political organization must file Form 990 or 990-EZ only if it has gross receipts of $100,000 or more. Political organizations may not submit Form 990-N.

When is Form 990 or Form 990-EZ due?

Form 990 or 990-EZ is due by the 15th day of the 5th month after the end of the tax year. Thus, for a calendar year taxpayer, Form 990 or Form 990-EZ is due on May 15 of the following year. If any due date falls on a Saturday, Sunday or legal holiday, the organization can file the return on the next business day.

Can I get help over the phone?

If you have questions and/or need help completing the form, please call 1-877-829-5500. Personal assistance is available Monday through Friday, 7:00 a.m. to 7:00 p.m. CT.

Where can I go for more information about tax-exempt organizations?

For more information on tax-exempt organizations see Tax Information for Charities & Other Non-Profits.

Tips for next year

Review the political organization resources at Tax Information for Political Organizations.

Understanding your notice

Reading your notice

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

Notice CP259H, Page 1

Notice CP259H, Page 2

Notice CP259H, Page 3

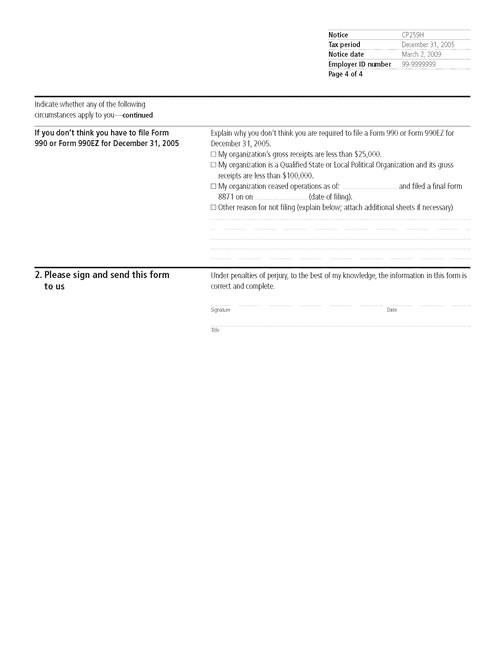

Notice CP259H, Page 4