Printer-friendly version

Supplemental Pay in the Finance and Insurance Industry

by John L. Bishow

Bureau of Labor Statistics

Originally Posted: April 21, 2010

This article examines the use of supplemental pay in the finance and insurance industry. Pay practices in this sector are currently of particular interest.

Introduction

Pay practices in the finance and insurance sector1 have garnered considerable attention recently, especially in relation to the current recession and steps taken by the U.S. Treasury to stabilize the financial sector.2 This article examines the use of supplemental pay--overtime, nonproduction bonuses,3 and shift differentials--in the finance and insurance sector. Supplemental pay4 differs from benefits such as health or life insurance in that the employee receives it as a cash payment. To emphasize this difference, the article focuses on supplemental pay as a percent of gross earnings.5 It uses a dataset that pools four quarters of NCS private industry data, spanning 2006 to 2009, using the first quarter of each year. On average, supplemental pay represents a small percentage of cash earnings for the U.S. labor force overall, but supplemental pay can be an important source of income for certain occupations.6

The finance and insurance sector is made up of companies that specialize in various forms of financial transactions. These include activities such as the creation, liquidation, or transfer of financial assets, as well as the facilitation of financial transactions. The major activities in this sector include raising funds by taking deposits or issuing securities, pooling risk by underwriting insurance and annuities, and providing specialized services related to financial intermediation, insurance, and employee benefit programs.7

The study begins by looking at how the use of supplemental pay in finance and insurance compares with other service-providing industries.8 Next, the use of components of supplemental pay--overtime, bonuses, and shift differentials--in the finance and insurance industry are compared with the average across all other service-sector industries. Finally, the use of supplemental pay in selected detailed industries that make up the finance and insurance industry are examined. However, confidentiality and reliability concerns do not allow an analysis at a finer level of detail, such as investment banking and securities dealings.

Supplemental pay in the service-providing sector

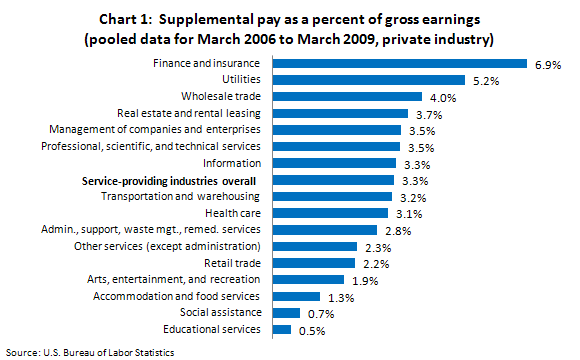

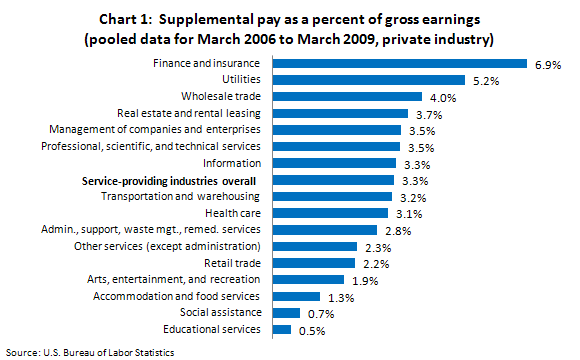

Chart 1 shows how the percent of gross earnings received as supplemental pay in the finance and insurance industry compares with that of other service-providing industries.

Supplemental pay (overtime, bonuses, and shift differentials combined) accounts for 6.9 percent of gross earnings in finance and insurance, compared with about 3.3 percent for the service-providing sector overall. Relative to other industries, finance and insurance is among the industries that pay the highest percentages of gross earnings in the form of supplemental pay--on a par with utilities and wholesale trade, and clearly greater than industries such as educational services, accommodation and food services, and retail trade.9

Chart 2 compares the use of overtime, bonuses, and shift differentials in finance and insurance with all other service-providing industries.10

With regard to the components of supplemental pay, the percent of gross earnings received as overtime is lower for finance and insurance than for other service-providing industries. The same holds true for shift differentials. The most striking difference is in the use of bonuses, which represent about 6 percent of gross earnings for finance and insurance, compared with about 1 percent for all other service-providing industries.

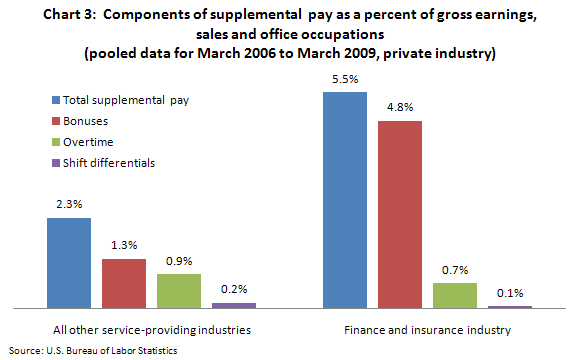

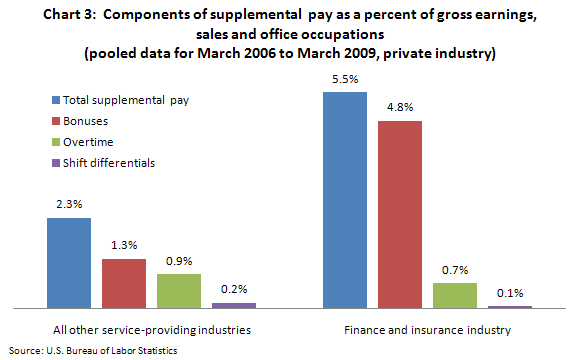

Charts 3 and 4 offer analogous comparisons of finance and insurance and all other service-providing industries across two broad groups: (1) sales and office occupations and (2) management, professional, and related occupations.11 These groups account for the bulk of the employment in the finance and insurance industry.12

In chart 3, it can be seen that, within sales and office occupations, the percent of gross earnings received as supplemental pay is higher for the finance and insurance industry than for all other service-providing industries. The higher percent of gross earnings received as bonuses clearly accounts for this difference.

Chart 4 shows that, for management, professional, and related occupations, the difference between the finance and insurance industry and all other service-providing industries appears to be more dramatic and is again driven by the higher percentage of gross earnings received as bonuses.

Supplemental pay in the detailed finance and insurance industries

For each of the detailed industries shown in chart 5, overtime and shift differentials represent less than 1 percent of gross earnings and thus have been excluded for convenience of exposition. Chart 5 shows that, among the detailed industries which make up finance and insurance, the percent of gross earnings received as bonuses is 5 percent for credit intermediation and related activities (NAICS 52-2000), and 4.4 percent for insurance carriers and related activities (NAICS 52-4000). For securities, commodity contracts, funds, and trusts,13 12.7 percent of gross earnings is received as bonus pay. Recall from chart 2 that bonus payments, on average, accounted for about 6.5 percent of gross earnings in finance and insurance overall.

Summary

This article examined the use of supplemental pay in the finance and insurance industry. Pay practices in this sector are currently of particular interest.

Unlike other benefits, such as retirement and health insurance, supplemental pay is received by the employee essentially as cash earnings. For this reason, the article focused on supplemental pay as a percent of gross earnings rather than as a percent of total compensation.

The percent of compensation received as supplemental pay in the finance and insurance industry ranked among the highest of all industries in the service-providing sector. This is driven by the use of bonus pay; the use of overtime and shift differentials was found to be negligible in this industry. Chart 6 illustrates the importance of bonuses in the finance and insurance industry relative to other service-providing industries.

The use of bonuses in the finance and insurance industry is clearly higher than the average across all other service-providing industries. Bonuses were found to play a particularly important role for management, professional, and related occupations within the finance and insurance industry. Among the detailed industries that make up the finance and insurance industry, the percent of gross earnings received as bonuses was higher for securities, commodity contracts, funds, and trusts than for the two other detailed industries.

John L. Bishow

Research Economist, Compensation Research and Program Development Group, Office of Compensation and Working Conditions, Bureau of Labor Statistics.

Telephone: (202) 691-7389; E-mail: Bishow.John@bls.gov.

Notes

1 This sector is composed of industries as defined by North American Industry Classification System (NAICS) code 52-0000. For more information on NAICS definitions, see the following Web site: http://www.bls.gov/bls/naics.htm (accessed March 1, 2010).

2 The Troubled Asset Relief Program (TARP), Capital Asset Program (CAP) and other measures by the U.S. Treasury taken to stabilize the economy are described at the following Web site: http://www.financialstability.gov/roadtostability/programs.htm (accessed March 1, 2010).

3 Nonproduction bonuses are cash payments given by the employer to the employee, usually annually. The payment is not directly related to the productivity of the individual employee. They differ from production bonuses, which are directly tied to the productivity of the individual employee and are included in wages. In this study, ‘bonuses’ refers only to nonproduction bonuses.

4 There are a number of reasons for treating the components of supplemental pay as benefits. Overtime is a premium payment (over and above the average hourly rate) for extra hours of work. Similarly, shift differential pay can be thought of as a premium paid for working during hours that are less convenient than those of the typical workday. Non-production bonus payments are treated as benefits because they are generally discretionary in terms of frequency and amount, and may vary significantly from employee to employee.

5 Gross earnings refer to the sum of wages, overtime, bonuses, shift differentials and paid leave.

6 See “A Look at Supplemental Pay: Overtime Pay, Bonuses and Shift Differentials.” Compensation and Working Conditions Online, March 25, 2009, on the Internet at http://www.bls.gov/opub/cwc/cm20090317ar01p1.htm (accessed March 1, 2010).

7 From the BLS online publication Industries at a Glance, Finance and Insurance, NAICS code 52-0000, on the Internet at http://www.bls.gov/iag/tgs/iag52.htm (accessed March 1, 2010).

8 Service-providing industries as defined by NAICS, on the Internet at http://www.bls.gov/bls/naics.htm (accessed March 1, 2010).

9 The industries are defined under the following NAICS codes: utilities, 22-0000; wholesale trade, 42-0000; educational services, 61-0000; accommodation and food services, 72-0000; and retail trade, 44-0000 through 45-0000.

10 “All other service-providing industries” refers to the average across all jobs in the service-providing industries except for those in finance and insurance.

11 The occupational groups are defined under the following Standard Occupational Classification (SOC) codes: management, professional, and related, 11-0000 through 27-0000; sales and office, 41-0000 and 43-0000. More information on the Standard Occupational Classification system is available on the BLS Web site at http://www.bls.gov/soc/ (accessed March 1, 2010).

12 Occupational Employment Statistics (OES) for May of 2008 indicate that sales and office occupations accounted for about 60 percent of employment in the finance and insurance industry, and management, professional, and related occupations accounted for over 35 percent of employment in this industry. For more information, see May 2008 National Occupational Employment and Wage Estimates, on the Internet at http://www.bls.gov/oes/2008/may/naics2_52.htm#(3) (accessed March 1, 2010).

13 This category is a combination of securities, commodity contracts, and other financial investments and related activities (NAICS 52-3000), and funds, trusts, and other financial vehicles (NAICS 52-5000).