Understanding your CP120A Notice

Your organization's tax-exempt status has been revoked for failure to file a Form 990 series return for three consecutive years. In addition, you are no longer eligible to sponsor a tax-sheltered annuity plan (Internal Revenue Code section 403(b) retirement plan).

Printable samples of this notice (PDF)

Tax publications you may find useful

- Publication 583, Starting a Business and Keeping Records

- Publication 557, Tax Exempt Status for Your Organization

- Publications 4221-PC, 4221-PF, and 4221-NC, Compliance Guides for Tax-Exempt Organizations

- Instructions for Forms 1023, 1024, 1041, and/or 1120

- Publication 4220, Applying for 501(c)(3) Tax-Exempt Status

- Form 990 Filing Threshold

- Notice 2011-43

- Notice 2011-44

- Rev. Proc. 2011-36

- Find a copy of any necessary tax forms and instructions

How to get help

Calling the 1-800 number listed on the top right corner of your notice is the fastest way to get your questions answered.

You can also authorize someone (such as an accountant) to contact the IRS on your behalf using this Power of Attorney and Declaration of Representative (Form 2848).

Or you may qualify for help from a Low Income Taxpayer Clinic.

What you need to do

- File any appropriate federal tax return such as:

- Review the instructions for these forms to determine whether and when your organization needs to file.

- Contact your state to determine how the revocation affects your state responsibilities and filing requirements.

You may want to...

- Apply for tax-exempt status.

- If you apply for tax-exempt status, you may request that your tax-exempt status be reinstated retroactive to the date your exempt status was revoked.

- Determine whether your organization is eligible for transition relief, available for small organizations seeking reinstatement of their tax-exempt status. The transition relief includes a reduced user fee and retroactive reinstatement.

Answers to Common Questions

I have a letter from you saying I don't have to file annually. What can I do?

Call 877-829-5500 (a toll-free number). You also can send a copy of the letter by fax or by mail to an office that will handle this problem. The office's fax number is 513-263-4330. Its address is:

IRS ― TEGE

P.O. Box 2508

Cincinnati, OH 45201

I have proof I met my filing requirements. What can I do?

Call 877-829-5500 (a toll-free number). You also can send copies of your proof by fax or by mail to an office that will handle this problem. The office's fax number is 801-620-5555. Its address is:

Internal Revenue Service

1973 North Rulon White Blvd

M/S 6552

Ogden, UT 84404

Are there any penalties for filing a Form 990 or Form 990-EZ late — or not filing it at all?

Yes. If an organization's annual gross receipts for the year are less than or equal to $1 million, the IRS can charge the organization a penalty of $20 for each day the return is late, not to exceed the lesser of $10,000 or 5% of the organization's gross receipts for the year. If an organization's annual gross receipts for the year exceed $1 million, the IRS can charge the organization a penalty of $100 for each day the return is late, not to exceed $50,000. The organization's tax-exemption is automatically revoked if it fails to file its return for three consecutive years.

Is there any way an organization that files a return late can be relieved of paying a penalty?

Yes. A penalty will not be imposed if the organization can demonstrate that its failure to file on time was due to reasonable cause. An organization that believes it has reasonable cause for failure to file should attach a cover letter to its return explaining the late filing.

We want to apply for tax-exempt status. How much is the user fee?

The user fee for an organization that files a Form 1023 or 1024 is $850, unless its average annual gross receipts over a 4-year period are $10,000 or less, in which case the user fee is $400. For more information on user fees, see Revenue Procedure 2010-8.

Before I fill out the application for tax-exempt status and pay the user fee, how do I find out if my organization qualifies for tax-exempt status?

For information regarding the types of organizations that qualify for exemption from federal income tax, see Publication 557, Tax Exempt Status for Your Organization.

How can I check on the status of my application for tax-exempt status?

To check on the status of your application, see Where Is My Exemption Application?

If my organization is a business and doesn't qualify for tax-exempt status, what type of tax return should we file?

The organization likely will need to file Form 1120, U.S. Corporation Income Tax Return, though it may be responsible for filing other tax returns. For information on business taxes and the appropriate returns to file with the IRS, see Publication 583, Starting a Business and Keeping Records.

Can I get help over the phone?

If you have questions and/or need help completing this form, please call 1-877-829-5500. This toll-free telephone service is available Monday through Friday, 7:00 a.m. to 7:00 p.m. CT.

Where can I go for more information about tax-exempt organizations and automatic revocation?

For more information on tax-exempt organizations see Tax Information for Charities & Other Non-Profits. For more information on automatic revocation, see Automatic Revocation of Tax-Exempt Status for Failure to File Annual Return or Notice - Frequently Asked Questions and Answers.

Tips for next year

If you are required to file a tax return:

- Review the instructions for the return.

- Keep records of all income and expenses.

Understanding your notice

Reading your notice

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

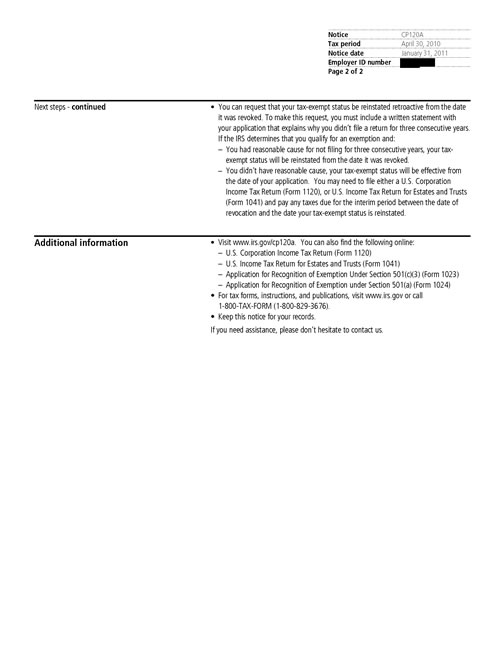

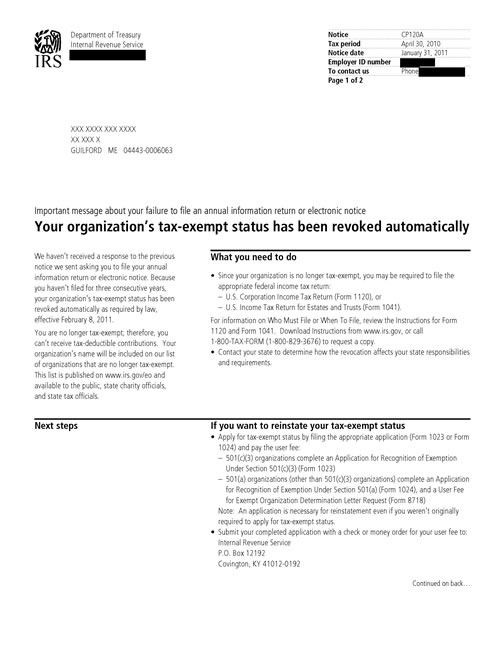

Notice CP120A, Page 1

Notice CP120A, Page 2