Printer-friendly version

Benefit Cost Concepts and the Limitations of ECEC Measurement

by Thomas G. Moehrle, John L. Bishow, and Anthony J. Barkume

Bureau of Labor Statistics

Originally Posted: July 26, 2012

Data on the benefits portion of employer costs for employee compensation (ECEC) can be used in conjunction with published benefit incidence statistics from the National Compensation Survey to obtain additional measures of employer costs for employee benefits. Using ECEC benefit measures combined with access and participation costs can provide new perspectives on the overall costs to employers of employee benefits.

Using the National Compensation Survey (NCS), the Bureau of Labor Statistics (BLS) produces quarterly data on Employment Cost Trends. The Employer Costs for Employee Compensation (ECEC) series presents estimates of the average hourly costs to employers for compensation, including wages and salaries and a variety of employee benefit categories, such as paid leave, health insurance, and retirement. The ECEC estimates are published across a number of series defined by industry, establishment size, and occupational characteristics. For instance, ECEC estimates are available by major industry and occupational groups as well as by union status and full- and part-time work schedules.1 The ECEC compensation estimates are averages that are measured across all workers, even though many workers may not receive certain benefits.

The ECEC approach to measurement provides a means to consistently add together the different benefit costs for a worker population to obtain a measure of total employer compensation costs and to identify the relative importance of a given employee benefit in total compensation.2 For example, table 1 shows a selection of ECEC estimates for sales and office workers in private industry. Of the $22.02 per hour total compensation of this occupational group, 71.6 percent of it is paid as wages and salaries, while the remainder (28.4 percent) is received as benefits.

Table 1. Employer Costs for Employee Compensation, sales and office occupations in private industry, March 2011

| Compensation component |

Cost per hour worked |

Percent of compensation |

Total compensation |

$22.02 |

100.0 |

Wages and salaries |

$15.75 |

71.6 |

Total benefits |

$6.26 |

28.4 |

Retirement |

$0.64 |

2.9 |

Health insurance |

$1.90 |

8.6 |

Vacation |

$0.68 |

3.1 |

Sick leave |

$0.18 |

0.8 |

Using the same NCS survey, the BLS also separately publishes employee benefit incidence statistics—access and participation rates—which provide the percentage of workers who have access to a particular benefit category or who participate in the offered benefit.3 These incidence statistics are published by many of the same industry, establishment, and occupational characteristics found in the ECEC.4 Since the compensation cost estimates and incidence rates are derived from the same survey and published across many of the same series, they together provide sufficient information to estimate employer costs not only measured across all workers—as the published ECEC statistics do—but also across the subset of workers who receive access to, or participate in, a benefit plan.

Although the ECEC statistics cover both wages and employee benefits, there is an important distinction between the two concepts that must be kept in mind when interpreting the ECEC benefit cost measures: all jobs pay a wage or salary, but not all employers offering these jobs incur costs for employee benefits. This distinction arises when either the employer does not provide the benefit to workers in the job or when workers choose not to participate in the benefit even when the employer offers it.5 Although ECEC has many uses, of which comparing relative compensation costs among benefit categories is not the least among them, those hourly costs can be, on average, much lower than what an employer pays when providing access to the benefit—access costs—or when workers with access actually participate in a benefit plan—participation costs. This article demonstrates how the ECEC benefit cost statistics and the NCS benefit incidence statistics can be used together to obtain measures of benefit costs that reflect differences in the incidence of benefits. Specifically, benefit access rates can be applied to ECEC benefit cost statistics to obtain a measure that shows how offering access to a benefit might affect the employer’s hourly labor costs. Similarly, participation rates can be applied to the ECEC benefits data to obtain a measure of the average benefit cost per participant.

Average costs for all workers and incidence costs of access and participation

ECEC benefit cost measures do not provide a measure of incidence costs—either access costs or participation costs—unless all workers are in establishments that have access to the benefit and all workers participate in the benefit plan. The ECEC benefit cost measures are averages computed using the all-worker population. However, the average cost of offering access to the benefit—referred to in this article as “access costs”—only includes the subset of workers in jobs in which the employer actually provides access to the employee benefit. Likewise, the average cost per worker receiving the benefit—or “participation costs”—only includes the subset of workers who actually participate in a specified benefit plan. Unlike published ECEC benefit costs, access costs and participation costs do not add up to total compensation. This is because the number of workers used to produce each estimate can be different for different benefits. (For example, more workers may be in jobs with access to paid leave than the number with access to health insurance benefits.) However, these additional measures could be useful in answering questions about benefit costs that appear to be of interest to many data users.

The following hypothetical case illustrates the important differences among the all-worker ECEC benefit cost measure, employer access costs, and worker participation costs. Assume that some employers pay a dollar amount per hour worked for the street parking costs of workers who drive to work, and that total employer costs are $450 every work hour.6 (Imagine that only time-metered parking is available to workers who drive.) Assume also that (1) the total worker population in a given occupation is 1,000 workers, with 100 employed in each of 10 establishments; (2) half of the establishments provide the parking benefit to drivers; and (3) in each establishment that provides the parking benefit, 10 percent of the workers do not take the parking benefit, because they either walk or take public transit to work. The different benefit cost measures can be thought of as dividing total employer costs by different worker populations. For the conventional ECEC benefit measure, these total employer costs are divided by the hours worked of the total worker population—1,000 hours in this hypothetical case—resulting in an average employer cost of $0.45 per hour worked. The average cost of providing access is obtained by dividing the total employer cost ($450 per hour) by the hours worked in establishments that actually provide the parking benefit—half of the 10 establishments, or 500 hours—resulting in a worker access cost of $0.90 per hour worked. Finally, the worker participation cost is $450 for every hour worked divided by the 450 workers actually receiving the benefit, or $1.00 per hour worked.7

Exhibit. Summary of hypothetical parking benefits example

| Assumptions: |

Summary of employer cost and computations: |

| Total employer costs are $450 per hour worked. There are ten employers, each employing 100 workers, or total employment equals 1,000. |

ECEC costs = $0.45 per work hour.

$450/1,000 = .45 |

| Half of all employers provide parking benefits. |

Access costs = $0.90 per hour worked.

5 of 10 employers — each employing 100 workers — provide workers parking benefits, or 500 workers have access.

$450/500 = .90 |

| Of the 5 employers offering parking benefits, 90 percent of their workers choose to participate in the benefit. |

Participation costs = $1.00 per hour worked.

9 out of 10 workers having access also participate, or 0.90 x 500 equals 450 workers who participate.

$450/450 = 1.00 |

Deriving estimates of average access cost and average participation cost

In the hypothetical example described previously (in which the ECEC measure for parking costs was $0.45 per hour worked, the employer access cost was $0.90 per hour worked, and the worker participation cost was $1.00 per hour worked), each measure had the same total employer cost in the numerator of the formula. In the denominator, the number of workers in the relevant population caused the difference between these benefit cost measures. In this section, the same example is used to demonstrate that the access cost can be expressed as the ratio of the relevant ECEC benefit cost measure to the benefit access rate (the latter expressed as a fraction rather than a percentage), and the participation cost can be expressed as the ratio of the relevant ECEC benefit costs measure to the benefit participation rate (again, with the latter expressed as a fraction rather than a percentage). This approach follows the previous work of Jason Ford, who demonstrated the use of this approach for the estimation of worker participation costs for health insurance.8

The hypothetical example presented in the previous section shows that each type of employer benefit cost can be defined as the ratio of total employer costs for the benefit to a different worker population. In the example that follows, the argument is limited to a particular employee benefit in a particular job; hence, the cost relationships can be expressed as

- ECEC benefit cost = Total employer costs / Employment in all establishments

- Employer access cost = Total employer costs / Employment in jobs providing access

- Worker participation cost = Total employer costs / Employment of participating workers

Note that employment of participating workers cannot be greater than employment in jobs providing benefit access, since a worker cannot participate in the benefit unless he or she is in a job that provides this benefit. The number of workers in the denominators of the formulas for the three benefit cost measures also determines the benefit access rate and worker participation rate since

- Access rate = Employment in jobs providing access / Employment in all establishments

- Participation rate = Employment of participating workers / Employment in all establishments

Given the interrelationships between the set of formulas for benefit costs and the sets of formulas for benefit incidence, benefit access cost and worker participation cost can be expressed in terms of the ECEC benefit cost and the corresponding benefit incidence measure. That is,

- Employer access cost = ECEC benefit cost / Access rate

- Worker participation cost = ECEC benefit cost / Participation rate

Thus, incidence cost estimates can be calculated by pairing ECEC costs with the appropriate incidence rates. Benefit access cost is estimated by dividing the ECEC benefit cost by the corresponding benefit access rate, and the worker participation cost for a particular benefit is similarly estimated by dividing the same ECEC benefit cost by the corresponding benefit participation rate.

An example of benefit cost comparisons

The difference in benefit expenditures between large and small establishments is often a topic for analysis. Tables 2 and 3 illustrate how the additional benefit cost measures described in this article might add to what can be learned from the existing ECEC benefit cost measures.

It is evident from examining the data in table 2 that published ECEC measures can substantially understate both average access costs and average participation costs, since the benefit incidence statistics in the table indicate that the appropriate subset of either workers with access to benefits or workers participating in plans—the denominator in the average cost computations—is substantially less than the measure of employment used for the ECEC benefit cost computations, which includes all workers regardless of access and participation.

Table 2. Selected National Compensation Survey data on employee benefits: employer costs, worker access rates, and worker participation rates, by establishment size, private industry, March 2011

| Characteristic |

ECEC benefit cost per hour worked |

Benefit access rate |

Benefit participation rate |

| Retirement Benefits: |

|

|

|

Establishments with fewer than 100 employees |

$0.59 |

49 |

34 |

Establishments with 100 or more employees |

$1.46 |

81 |

66 |

| Health Insurance Benefits: |

|

|

|

Establishments with fewer than 100 employees |

$1.46 |

57 |

43 |

Establishments with 100 or more employees |

$2.88 |

85 |

69 |

| Vacation Leave Benefits: |

|

|

|

Establishments with fewer than 100 employees |

$0.65 |

70 |

|

Establishments with 100 or more employees |

$1.36 |

86 |

|

The data in table 2 also indicate that the ECEC benefit cost measures may overstate differences in relative employer access costs or worker participation costs between small (fewer than 100 employees) and larger (100 or more employees) establishments. The ECEC benefit costs for the larger establishments range from $1.46 for retirement benefits to $2.88 for health insurance benefits—roughly double the corresponding measures for the small establishments. However, table 2 also shows that the benefit participation rate in larger establishments is substantially higher for both retirement and health insurance benefits, so that the relevant worker participation costs in larger establishments will be clearly less than double those in the small establishments.

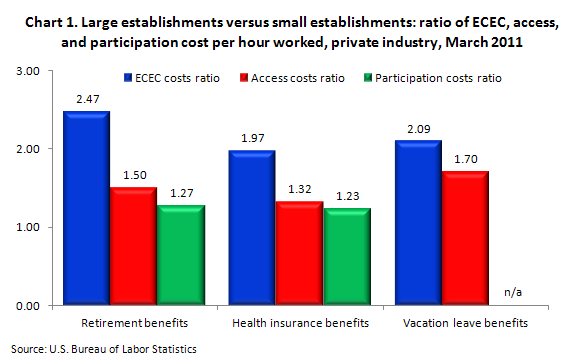

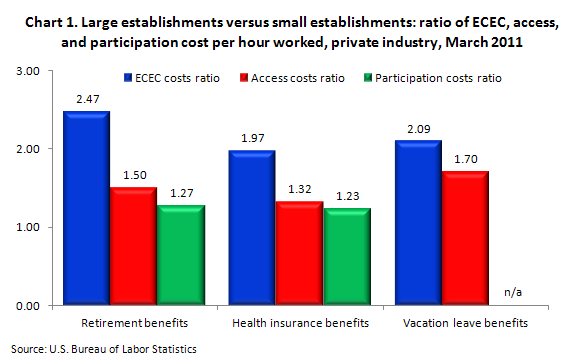

Table 3 shows the results of making these calculations on the data in table 2, allowing a comparison with the corresponding ECEC benefit cost measures. The employer access cost and worker participation cost estimates are naturally higher than the ECEC benefit cost estimates. Moreover, the ratios9 of costs across large and small establishments shown in chart 1 are smaller for both access costs and participation costs than they are for the published ECEC benefit cost measures. For retirement benefits, the relative cost in the larger establishments decreases from 2.47 times those in the smaller establishments to a corresponding ratio of 1.50 for employer access costs and 1.27 for worker participation costs. For health insurance benefits, the relative cost in the larger establishments decreases from 1.97 times those in smaller establishments to a corresponding ratio of 1.32 for employer access costs and 1.23 for worker participation costs.

Table 3. Published Employer Costs for Employee Compensation data on benefit costs and estimates of access costs and participation costs, by establishment size, private industry, March 2011

| Characteristic |

ECEC benefit cost per hour worked |

Employer access cost per hour worked |

Worker participation cost per hour worked |

| Retirement Benefits: |

|

|

|

Establishments with fewer than 100 employees |

$0.59 |

$1.20 |

$1.74 |

Establishments with 100 or more employees |

$1.46 |

$1.80 |

$2.21 |

| Health Insurance Benefits: |

|

|

|

Establishments with fewer than 100 employees |

$1.46 |

$2.56 |

$3.40 |

Establishments with 100 or more employees |

$2.88 |

$3.39 |

$4.17 |

| Vacation Leave Benefits: |

|

|

|

Establishments with fewer than 100 employees |

$0.65 |

$0.93 |

|

Establishments with 100 or more employees |

$1.36 |

$1.58 |

|

Chart 1 also shows that, while on an ECEC basis the relative cost of retirement benefits is substantially larger than the corresponding relative cost for health insurance benefits, on a worker-participation basis the relative cost differences between the two benefits are very small. The decrease in the cost ratios shows that a portion of the difference in the cost between the large and small establishments seen in the ECEC benefit cost measures is the result of lower access and participation rates found in smaller establishments.

Conclusion

The Employer Costs for Employee Compensation (ECEC) program provides benefit cost data for various industry, establishment size, and occupational characteristics. For whichever group of workers is being considered—be it by industry, occupation, union affiliation, or full- and part-time status—the published ECEC benefit cost measures are averages computed using the total employment in the group. This approach makes it possible to measure the relative importance of individual benefit expenditures as percentages of total compensation. However, ECEC statistics include workers who do not have access to the benefit or choose not to participate in it. Including these workers results in a cost measure that is lower than what is found when access to and participation in the benefit plan are taken into account.

This article examined a method by which published ECEC benefit cost data can be used in conjunction with published NCS benefit incidence statistics to obtain additional measures of employer costs for employee benefits. It was shown that estimates of employer access cost for benefits can be obtained by dividing the ECEC benefit cost by the appropriate access rate. Similarly, estimates of the worker participation cost can be obtained by dividing the ECEC benefit cost by the participation rate. A brief example presented in the article shows that using ECEC benefit cost measures alone may overstate differences in relative access costs or participation costs between small and large establishments. Using the additional cost measures described here—access costs and participation costs—can offer new perspectives on employer benefit costs.

Thomas G. Moehrle

Economist, Compensation Research and Program Development Group, Office of Compensation and Working Conditions, Bureau of Labor Statistics.

Telephone: (202) 691-6237; E-mail: Moehrle.Thomas@bls.gov.

John L. Bishow

Research Economist, Compensation Research and Program Development Group, Office of Compensation and Working Conditions, Bureau of Labor Statistics.

Telephone: (202) 691-7389; E-mail: Bishow.John@bls.gov.

Anthony J. Barkume

Chief Senior Research Economist, Compensation Research and Program Development Group, Office of Compensation and Working Conditions, Bureau of Labor Statistics.

Telephone: (202) 691-7527; E-mail: Barkume.Anthony@bls.gov.

Notes

1 For the latest Employer Costs for Employee Compensation news release, which includes some of the many data series in which compensation statistics are published, see http://www.bls.gov/ncs/ect/#news.

2 For additional information on the objectives of ECEC measurement, see Felicia Nathan, “Analyzing Employer Costs for Wages, Salaries, and Benefits,” Monthly Labor Review, October 1987, http://www.bls.gov/opub/mlr/1987/10/art1full.pdf.

3 This article does not consider how the differences in measurement protocol of access and participation rates could affect the estimation of different benefit cost measures. Participation in a benefit is measured directly, in each sampled occupation, by counting the numbers of workers who participate in the provided benefit. In contrast, access rates assume that all workers in the sampled occupation have access to a benefit if it is offered to at least one worker in the occupation, even though some workers may not have access because they have not yet fulfilled length-of-service requirements.

4 For the latest Employee Benefits in the United States news release, see http://www.bls.gov/ncs/ebs/#news.

5 Employees may choose not to participate in a benefit plan if there is a shared cost responsibility between the employer and the employee. This is common among health and retirement plans.

6 The NCS does not collect information on the incidence or cost of parking subsidies.

7 If all the workers who have access to the benefit choose to participate in the benefit, the access cost will equal the participation cost. If some of the workers who have access to the benefit choose not to participate in the benefit, the access cost will be lower than the participation cost. Hence, the access cost will always be less than or equal to the participation cost.

8 See Jason L. Ford, “The New Health Participation and Access Data from the National Compensation Survey,” Compensation and Working Conditions Online, October 26, 2009, http://www.bls.gov/opub/cwc/cm20091022ar01p1.htm. Ford labeled his estimates of worker participation cost for health insurance as “modeled” because the estimate using the approach outlined here is subject to rounding error.

9 These ratios are obtained by dividing the cost for large establishments by the cost for smaller establishments.