Understanding your CP51C Notice

We computed the tax on your Form 1040, 1040A or 1040EZ. You owe taxes.

What you need to do

- Read your notice carefully. It will explain how we calculated your tax return.

- You don't need to do anything if you agree with our calculations.

- Contact us if you disagree with the amount of tax we computed.

You may want to...

- Download copies of the following materials (if they were not included with your notice):

- Call 1-800-TAX-FORM (1-800-829-3676) to order forms and publications.

- Complete and send us a Form 2848, Power of Attorney and Declaration of Representative to authorize someone (such as an accountant) to contact us on your behalf.

Answers to Common Questions

What should I do if I disagree with the notice?

Call us at the toll free number on the top right corner of your notice. Please have your paperwork (such as cancelled checks, amended return, etc.) ready when you call.

Tips for next year

Consider filing your taxes electronically. Filing online can help you avoid mistakes and find credits and deductions that you may qualify for. In many cases you can file for free. Learn more about e-file.

Understanding your notice

Reading your notice

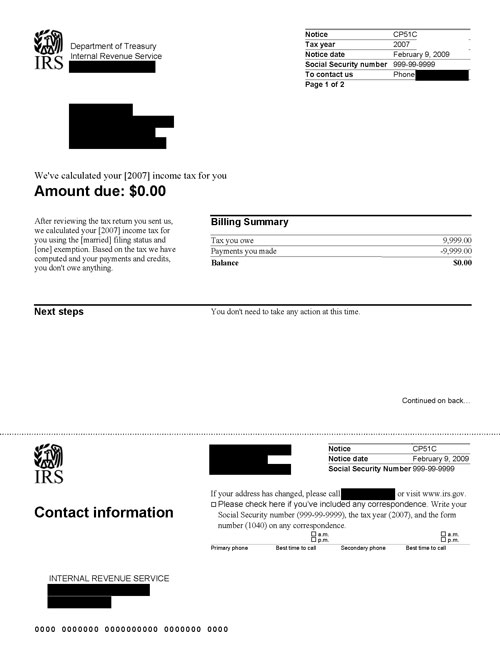

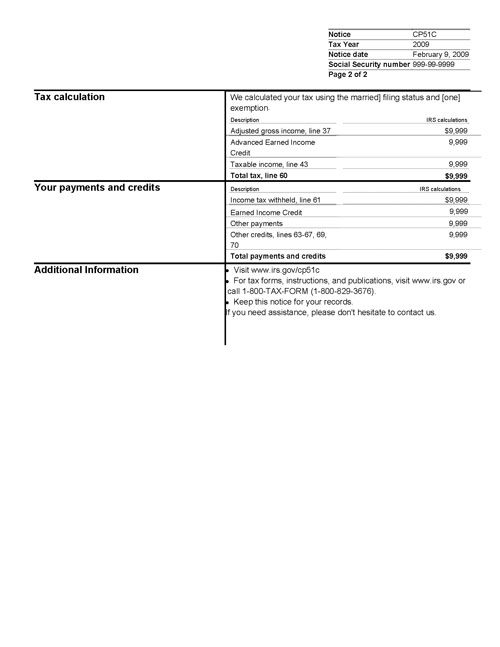

Your notice may look different from the sample because the information contained in your notice is tailored to your situation.

Notice CP51C, Page 1

Notice CP51C, Page 2

Printable samples of this notice (PDF)

Tax publications you may find useful

- Publication 967, The IRS Will Figure Your Tax

- Find a copy of any necessary tax forms and instructions

How to get help

Calling the 1-800 number listed on the top right corner of your notice is the fastest way to get your questions answered.

You can also authorize someone (such as an accountant) to contact the IRS on your behalf using this Power of Attorney and Declaration of Representative (Form 2848).

Or you may qualify for help from a Low Income Taxpayer Clinic.